Q2 Debt Market Overview

The article represents subjective opinions of Hines Interest Limited Partnership (“Hines”1), the sponsor of investment vehicles offered by Hines Private Wealth Solutions LLC (“Hines Private Wealth Solutions”). Other market participants may reasonably have differing opinions.

Capital Conundrum

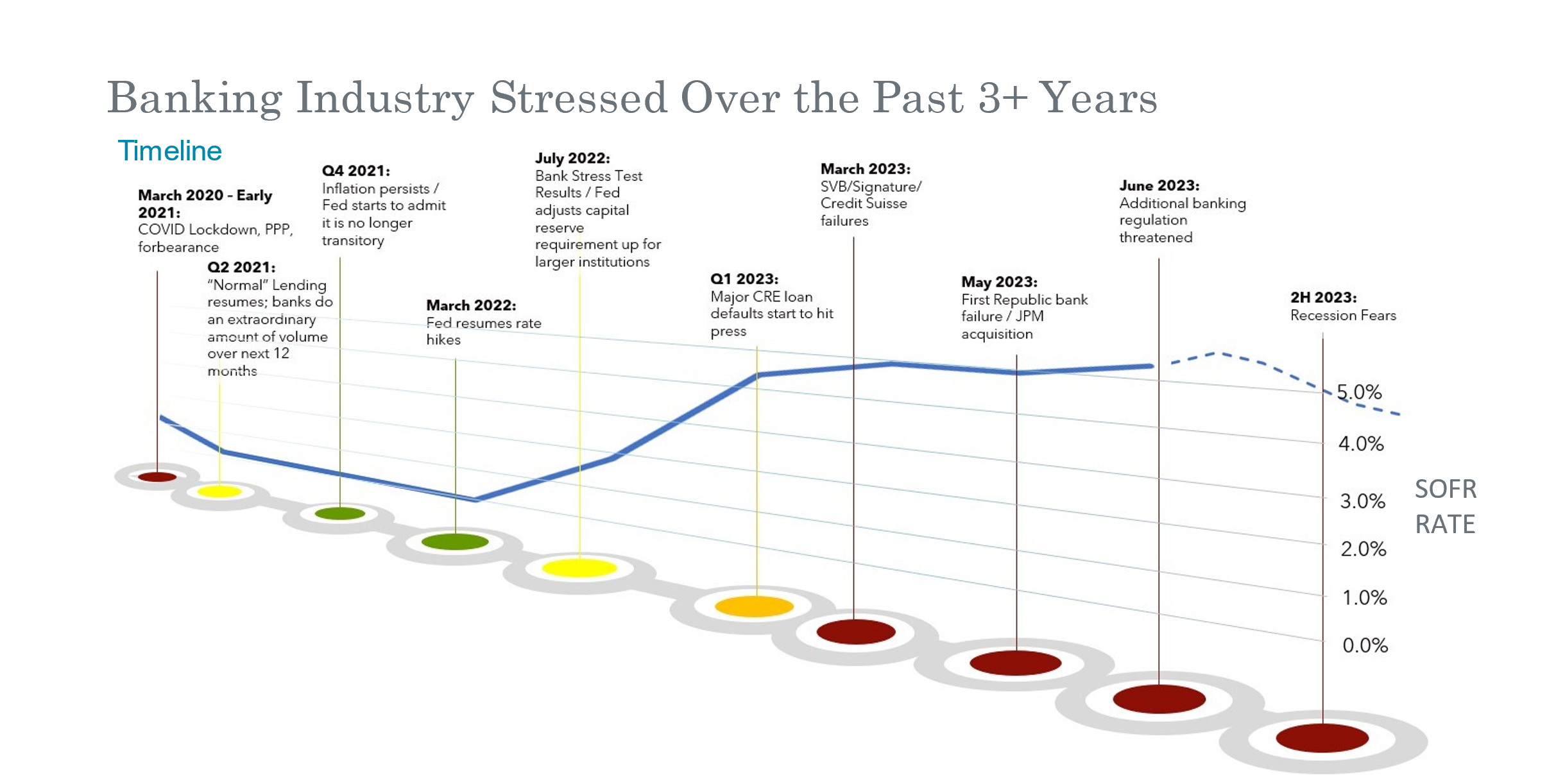

Even though the topic has fallen from the front page, there is no shortage of news sounding the alarm over the health of regional banks. Since March 2020, the entire banking industry has faced a number of stressors (see the graphic below) – being forced to adjust to rapid rate hikes, new reserve requirements, and reduced liquidity.

SOFR Rate Source: https://www.newyorkfed.org/markets/reference-rates/sofr

In some cases, these pressures led to failures of under-capitalized institutions (like Silicon Valley Bank), but these conditions have also resulted in lower credit availability. This obviously is a problem for commercial real estate borrowers needing funds or facing short-term maturities.

Obtaining investment financing is much more difficult and pricier as of July 2023 than 18 months ago, but Hines remains optimistic that funding is still available from a variety of lender types for strong deals with strong sponsors.

U.S. Financing Conditions

Austin Drake, who leads debt financing at Hines, says “U.S. debt capital is available but the mix of providers (and offering terms) has changed considerably” (see his summary below). Overarching themes include higher interest rate spreads, lower leverage, and more structure.

- Banks have been focused on reducing loan commitments and shoring up depository bases. As a result, new loan origination has become muted. Exposure to underperforming loans has banks focused on asset management and helping troubled borrowers remain current.

- Life insurance companies are aggressively pursuing term financing for preferred asset classes, including industrial, multifamily, and retail. They have provided more prepay flexibility and floating rate options for both term and construction loans.

- Due to their charters, government-sponsored enterprises (“GSEs”) have remained a reliable source of liquidity for multifamily product. With year-to-date volumes down, the GSEs have been entertaining market-rate transactions, but remain committed to “mission driven” assets, i.e. “green” and affordable housing. Fixed and floating-rate options are available.

- Debt funds have had significant capital available for all types of loan structures, but at elevated rates. Hines believes debt funds are best suited for larger bridge and construction loans.

- Conduits (loans secured by mortgages on commercial properties) are often bundled into commercial mortgage-backed securities (“CMBS”). Drake noted that this volume dropped about 80% year-over-year, and no single asset, single borrower (“SASB”) transactions have been originated in over a year. Investor demand and pricing has continued to swing with broader volality in the Treasury and corporate bond markets.

Rate Conditions in Europe

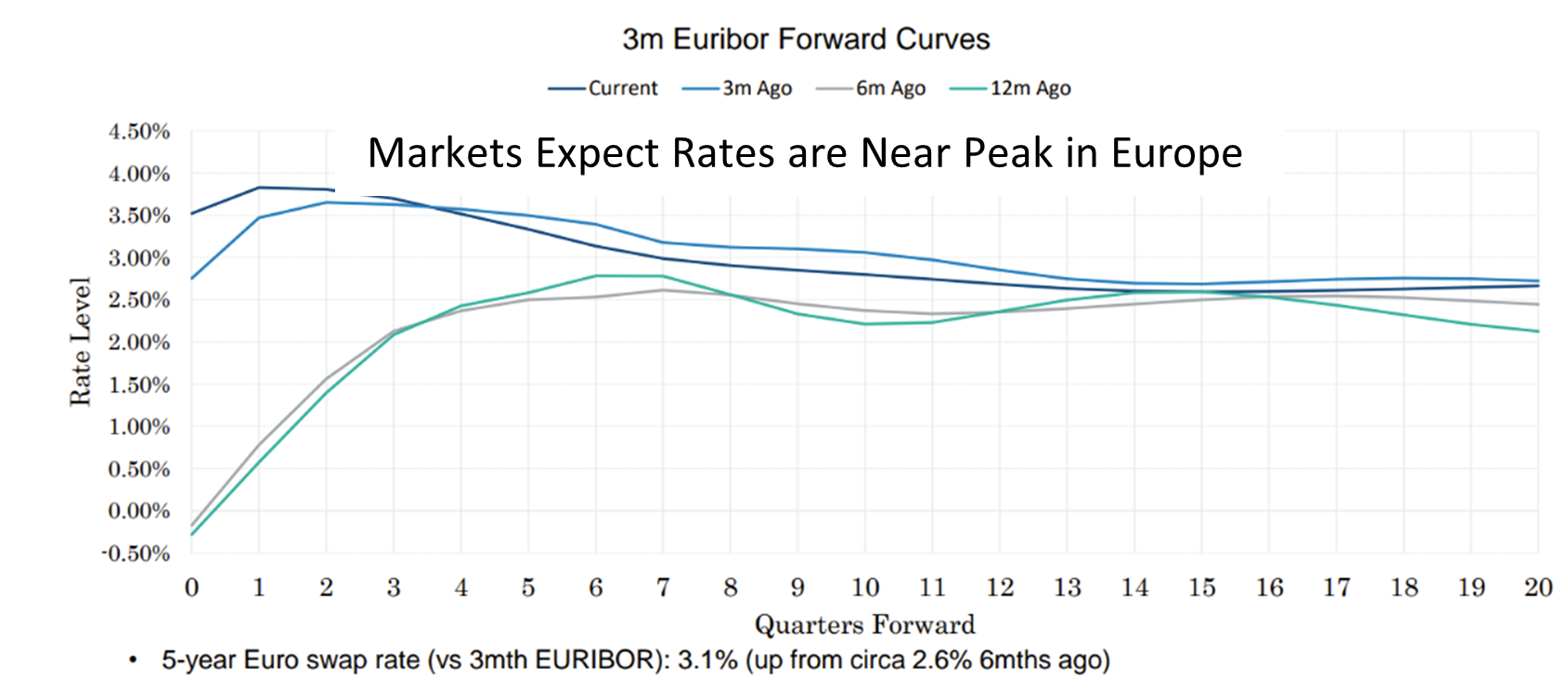

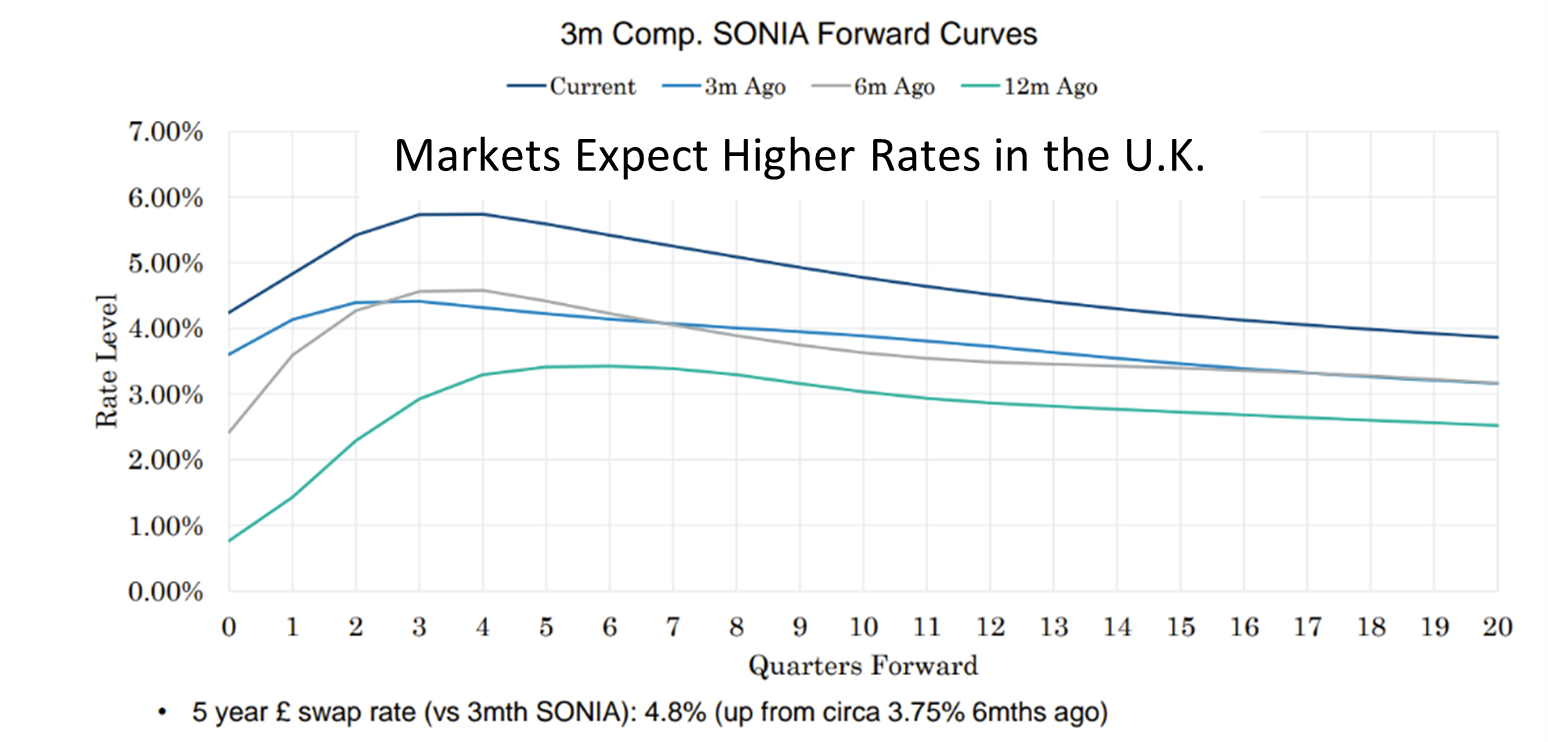

The interest rate picture is somewhat different across the Atlantic. The European Central Bank (ECB) raised its benchmark rate to 3.75% in late July. Ian Brown, senior managing director for Hines U.K., noted that while this is the highest in 22 years, it is still significantly below U.S. and U.K. levels. Markets expected the July hike, but Brown observed that this might be the last in the region, as the forward three-month Euribor2 curve currently peaks around 4% before slowly falling in 2024 (see graphic above). The outlook in the U.K. according to the forward curve is for continued rate increases (including the 50 basis point hike on June 22, 2023), with its counterpart rate peaking close to 6% in late 2024 (see next graphic). Interestingly, interest rate expectations in Europe haven’t changed much since April 2023, although in the U.K., expectations have jumped almost 100 basis points over the same period, possibly implying that investors feel the inflation battle has not yet been won.

About Liquidity

Brown reports that in general, Hines believes that there is good liquidity in Europe for strong sponsors and projects. The living and logistics sectors have been particularly well bid, with growing interest being seen in life science, self-storage, retail parks, and hospitality projects. Similar to the U.S., there are a considerable number of alternative European lenders that may help to fill the gap.

Office financing has become more difficult, and is increasingly focused on the newest, most modern projects. Liquidity for value add and development financing is more likely to originate from debt funds and insurers. Large deals requiring syndication have become more expensive, in part because not all funding sources are active, and regional banks are not always willing or able to participate.

Brown also noted that the increased cost of debt (around 7% in late June 2023) is making leverage in the U.K. much less attractive. In addition, senior3 loan-to-values now do not often exceed 55%, with banks remaining more conservative to ensure acceptable interest coverage. Refinancing gaps have become common, but so far, banks have been willing to work with current borrowers.

Capital is Still Available, But…

While Hines project funding is still available, the math is quite different compared to 18 months ago. Rates are up dramatically (as is the cost of hedging, important for cross-border investors), which impacts the ability of developers to hit return targets. If forward curves are correct, it appears Europe may be first to cease interest rate hikes with its benchmark rate projected to peak during the summer of 2023. The US may not be far behind, given the good news on inflation reported for June. We believe all of this bodes well for large, experienced investment managers with the resources and access to capital who can use it judiciously to take advantage of distressed opportunities globally.

Published August 2023.